One of the reasons that CECL was created by FASB was to force banks to be quicker to adapt to changing market conditions. They wanted banks to be faster to increase their reserves in worsening credit cycles and lower their reserves during improving credit cycles. That goal was primarily achieved by requiring lifetime loss calculations. In the past, a small change in the historical loss rate would result in a relatively minimal change in the overall reserve calculations. However, with the introduction of the remaining life multiplier, a relatively small change in the historical loss rate will result in a much bigger increase to the reserve calculation. For example, if a bank’s annual loss rate in a certain pool grows from 0.2% to 0.3%, the old ALLL reserve calculation would have increased 10 basis points for that pool. Under CECL, if that same bank has a remaining life of 4 years for the pool, a 10-basis point increase in the loss rate would result in a 40-basis point increase in its reserve calculation (0.1% increase in loss rate times a 4-year life = 0.4% total increase).

Many bankers are looking for as much stability as possible in their CECL models to minimize the earnings fluctuations that will result. One way that can be achieved is to pick the most conservative lookback period possible for historical loss rates when the model is implemented. As the last major credit cycle becomes a more distant event, more of our clients are using a fixed starting point for historical loss rates to preserve those losses in their historical loss rate calculations.

In today’s credit climate, if a bank uses a relatively short lookback period, they will get very low loss rates. However, when the next credit cycle hits, average historical loss rates will grow relatively quickly, which will have a big impact on the overall reserve calculation (especially with the lifetime multiplier impact discussed above). If a bank goes back to the beginning of the last credit cycle, their historical loss rate will be larger today, but when the next credit cycle hits, their average loss rate will be more stable because they already had big loss rates in their previous historical loss rate calculations. They also will have more quarters in the historical data so a new quarter will not have as much impact on the average calculation.

The last time loss rates increased, regulators required many banks to shorten their lookback periods so that their reserve calculations were more sensitive to recent changes. However, as the loss rates improved, many regulators wanted banks to lengthen their lookback periods to get more of a “through-the-cycle” loss rate. It would not be surprising if this happens again under CECL. At this point, the most conservative approach would be to set a starting point at the beginning of the last credit cycle and fixing it there until a new credit cycle commences.

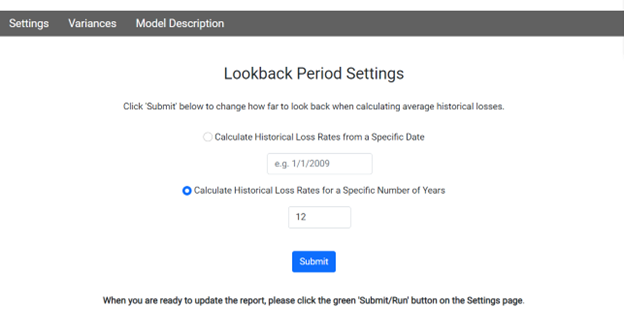

One of the new features of CECLcomp is the ability to experiment with different lookback period assumptions and to fix a starting point for historical loss rate calculations, if desired. This can be done from within a report by clicking the “Settings” menu and then clicking the “Lookback Assumptions” button. If the first option is chosen (Calculate Historical Loss Rates from a Specific Date), then the historical loss calculations will start with the specified date and a new quarter will be added each time the report is updated. If the second option is chosen (Calculate Historical Loss Rates for a Specific Number of Years), then the oldest quarter will be dropped each time the report is updated, and a new quarter will be added. You can experiment with different time periods by changing these settings and updating the report as much as you want. Below is a screenshot of the Lookback Assumptions page:

Recent Comments