Stress testing holds significant importance for community banks as it enables them to evaluate their resilience in adverse economic scenarios, identify vulnerabilities, and strengthen risk management practices. By quantifying potential losses and risks, stress testing supports informed decision-making and strategic planning. It also helps community banks meet regulatory requirements, enhance internal controls, and maintain stakeholder confidence. Overall, stress testing is a valuable tool for community banks to manage risks, enhance financial resilience, and ensure long-term sustainability in a dynamic banking environment.

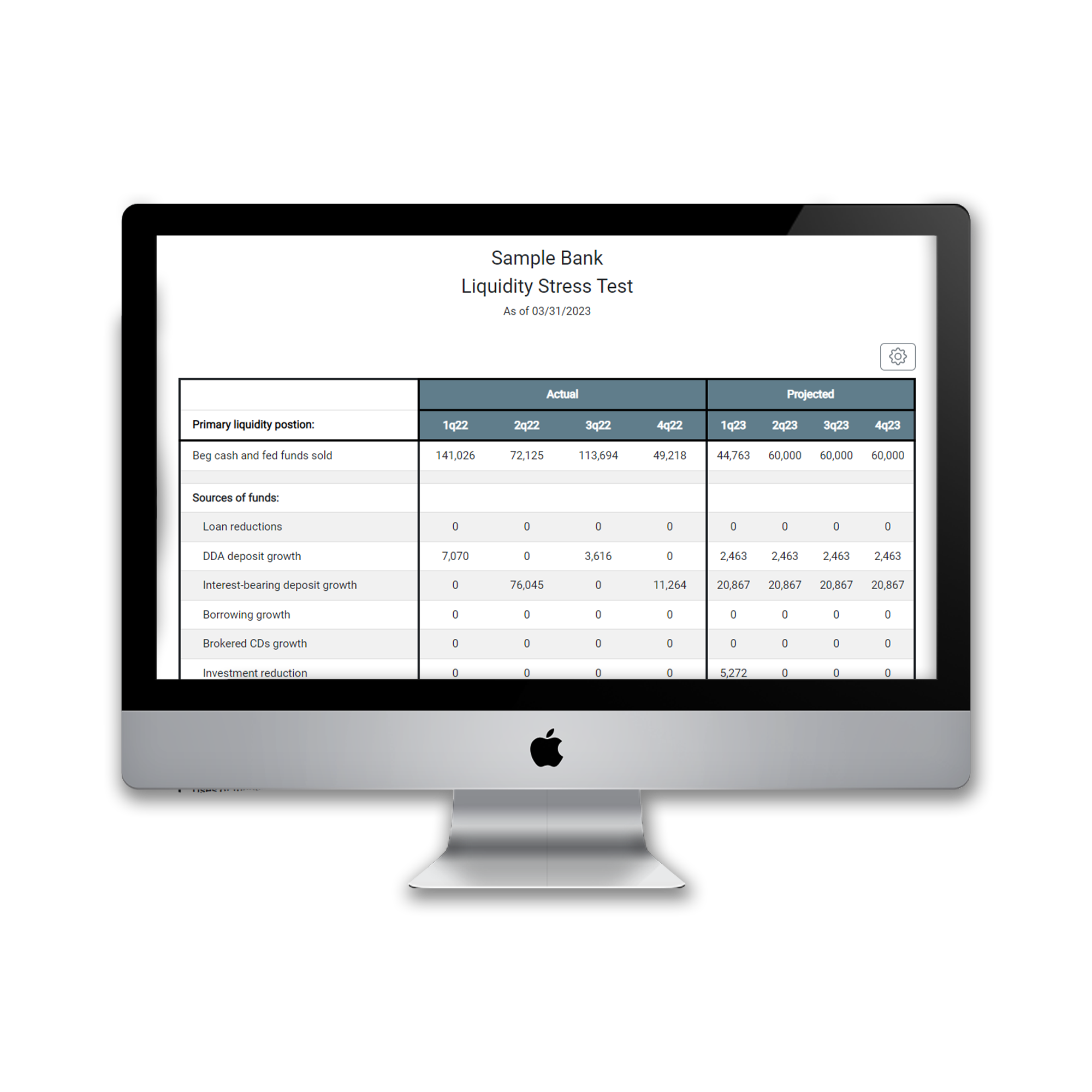

Liquidity Stress Testing

Liquidity stress testing is crucial for community banks as it helps assess their ability to withstand adverse financial conditions and meet their short-term obligations. With recent instances of major bank liquidity failures, regulators have heightened their expectations for contingency planning. This stress model allows banks to swiftly and effortlessly identify vulnerabilities and potential liquidity crises. By doing so, banks can proactively plan for potential liquidity shortfalls, diversify funding sources, and maintain adequate liquidity buffers to meet customer demands and regulatory expectations.

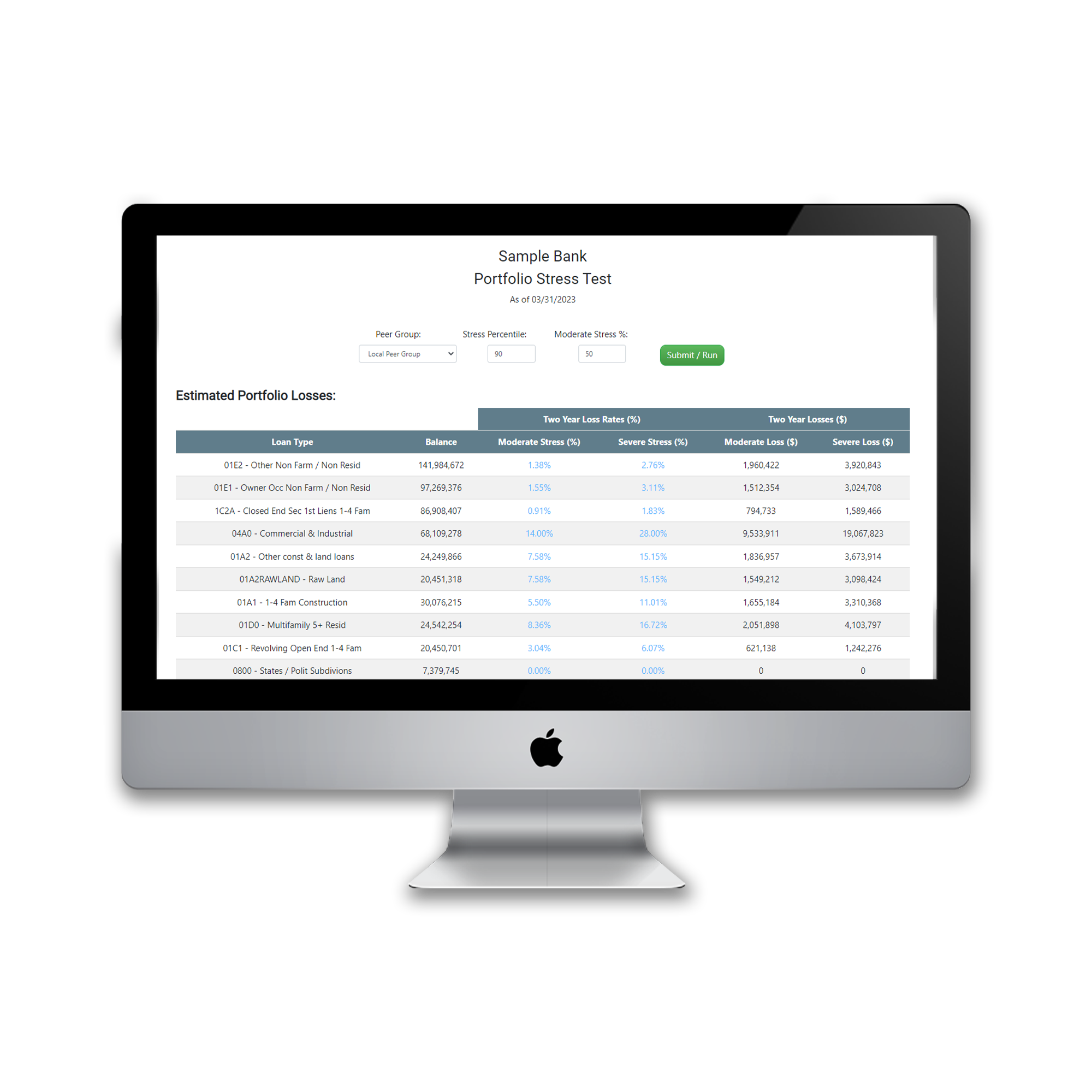

Portfolio Credit Stress Testing

Portfolio credit stress testing provides insights into the bank’s capital adequacy by assessing the potential losses in loan portfolios under stress scenarios. It helps community banks ensure they have sufficient capital buffers to absorb potential losses, maintain regulatory compliance, and support continued lending activities. Banks can quickly determine what a severe and moderate credit stress scenario would be for different types of loans, based on 40 years of history for banks in their area.

Credit Risk Stratification

Stress testing using a credit risk stratification matrix provides community banks with valuable insights to proactively manage credit risks, strengthen their risk management practices, and enhance their overall financial stability. It enables them to assess the potential impact of adverse scenarios on their loan portfolio. By subjecting different risk categories within the matrix to stress scenarios, banks can evaluate the resilience of their loan portfolio and identify vulnerabilities. This process helps banks determine the potential losses they may incur under adverse economic conditions, assess the adequacy of their capital reserves, and develop appropriate risk mitigation strategies.

.